Our point of sale systems (POS) a good investment for my grocery store? How much does a POS system cost? Whether you already own a POS, use an electronic cash register, or are in the middle of opening a new store, there are two primary things to investigate when signing up for a new POS system.  First, does the POS system you are purchasing force you to use a specific credit card processor, not allowing you to choose your own based on who has the most competitive credit card processing rates? Second, if you have a POS system, does it provide a return on your investment or is it a cash drain?

First, does the POS system you are purchasing force you to use a specific credit card processor, not allowing you to choose your own based on who has the most competitive credit card processing rates? Second, if you have a POS system, does it provide a return on your investment or is it a cash drain?

Does my POS offer a competitive Processing Rate?

First, let’s look at processing rates. An iPad-based POS that is currently dominating the market is 2.75% + .10 cents per swipe. We dug into the data and worked out that an average two register market does around 33,350 transactions a year at an average of $30.00 per transaction. That means grocery stores are paying around 93 cents per transaction, which adds up to $31,015.50 per year. Although 2.75% + 10 cents sounds cheap, when you do the math it quickly becomes apparent that this rate is not as competitive as you initially might think. Let’s look at another example. In 2015, a 16-year-old, Windows-based software company was acquired by a payment processor. They provide a seemingly attractive package because customers only have to pay around $800.00 upfront for software that can be installed on any Windows machine. But there’s a catch, the customer is required to use Heartland payments. The normal rates are 2.55% + 12 cents per swipe. That means they will be paying around 87 cents a transaction, and around $29,014.50 per year, based on 33,350 transactions per year. The most important question to ask when you are getting a POS system is, “Can I choose my processor?” since choosing one of the processors mentioned above can add extra and unnecessary costs.

means they will be paying around 87 cents a transaction, and around $29,014.50 per year, based on 33,350 transactions per year. The most important question to ask when you are getting a POS system is, “Can I choose my processor?” since choosing one of the processors mentioned above can add extra and unnecessary costs.

It is important to mention that there are additional costs that cannot be avoided when choosing a processor. This is called the interchange rate. The rate changes twice a year in April and October and is determined by Visa, Mastercard, AMEX, and Discover. We did some research and found that the average interchange rate charged as a percentage is 1.88% (Curated by Value Penguin).

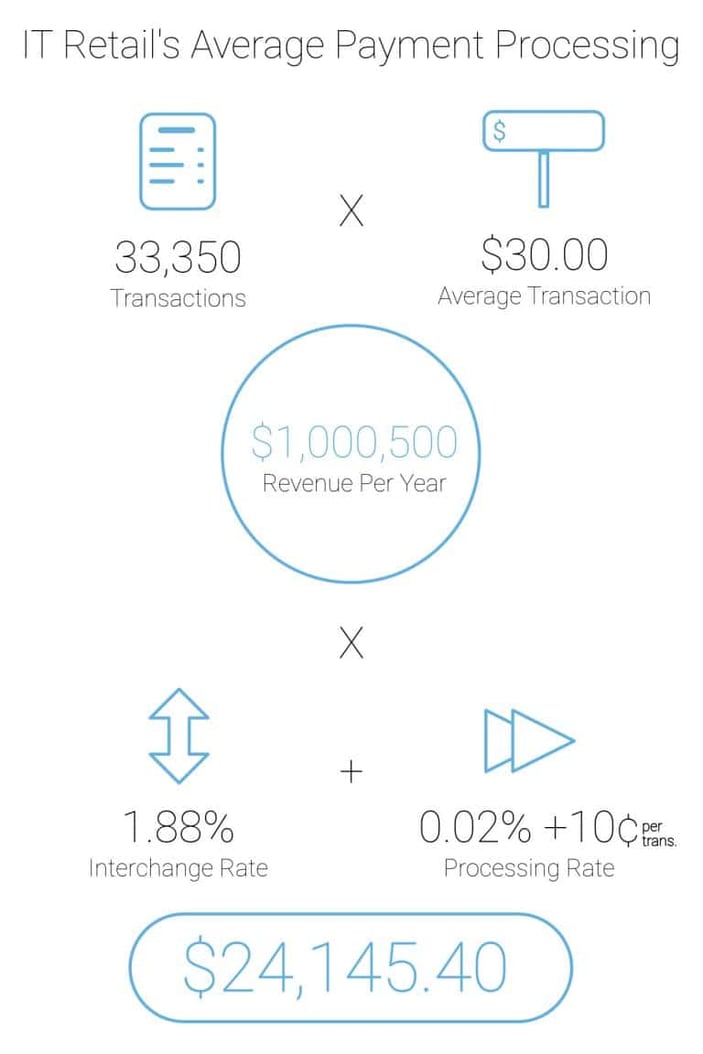

Let’s do the math again. 33,350 (transactions) * $30.00 (Average Grocery Transaction size) = $1,000,500 (Revenue per year) * 1.88% (average interchange) = $18,809.4 (cost of interchange). Unfortunately, no processor is going to give their customers processing at cost so we need to add the small grocery national average range which is .20% +.10 per transaction. Based on everything we have detailed above, you now know that .20% +.10 per transaction is the max you should allow yourself to be charged. So what does the math look like now? $1,000,500 (Revenue per year) * (1.88% +0.20%) + $0.10 * 33,350 = $24,145.40.

For the grand finale, let’s look at how much a customer would be overcharged if they chose the cheaper of the two POS options which forces them to use their payments = $29,014.50 – $24,145.10 = $4,869.30. Hmm, that looks like the price of a POS system. If they keep that system for 5 years, it adds up to a whopping $24,346.50 *Please note, percentages do change over time.

So how do you get the most competitive processing rate? Talk to other local store owners and ask what they are paying in processing rates. From there, you can request rate quotes from a few processors and compare them to the data points you already have. There are multiple processing companies and the market is highly competitive, processors will want to fight for your business and you should let them. Heartland, Vantiv, Chase, TSYS, and First Data are some examples of popular processors.

What is the Return on my Investment in a Grocery POS system?

The second major question we want to explore is whether or not the POS has paid for itself, or in other words, what is the return on the investment? On average, legacy point of sale systems cost around $5000 per lane. In that $5000 investment, the store receives the following: a software license, computer, printer, cash drawer, scanner-scale, cashier display, customer display, mounts, and PIN pad. In addition to that, the software license is around $3000 per year. For a two-lane grocery store, the rough investment in a grocery POS is about $13,000, which is not a small investment. You might be thinking:

“How do I justify switching from an electronic cash register which costs about $200 to a system which costs $13,000? It’s just a waste of money!”

There are a lot of ways to calculate the return on the investment of a point of sale system, and some point of sale systems provide a better return on investment than others.

The first way is employee labor. Have you optimized your scheduling with your transaction volume? Do you know when the rushes and mini rushes are? Optimizing labor is one of the easiest ways to reduce costs.

The second way to save is by reducing the time it takes to change prices. Most stores running a cash register price each product individually with stickers. With a POS system that offers product labels, you can reduce the labor cost of pricing by more than 50%. Placing labels may take an initial investment, but after this, the only time you’ll need to change them is when you change your price.

Third, it reduces the time to check out customers. Retail MARKET has had great success in helping stores reduce lines by implementing a grocery-optimized POS system. Not only does it reduce lines, but the system also increases accuracy since manually entering prices with every product is risky and errors are easily made.

Fourth, it provides the owner instantaneous reports to their phone, tablet, or laptop. This enables the owner a great deal of flexibility and confidence to run their store from anywhere they choose – from their office, their child’s soccer game, or anywhere in the world! The cloud today gives you that flexibility.

Lastly, does your electronic cash register or POS uses advanced algorithms to find suspicious activity from the store’s cashiers? Around 5% of a store’s total revenue goes to employee theft each year! A good POS will highlight risky behavior and get that money back in your pocket!

I hope these tips help you out in your POS decision-making! We recently put together a cost savings calculator. Try it out for fun and see if Retail MARKET could save you money.

If you would like to buy a POS but do not have $13,000 to invest in one, check out this article, it has great information on business loans.